Content

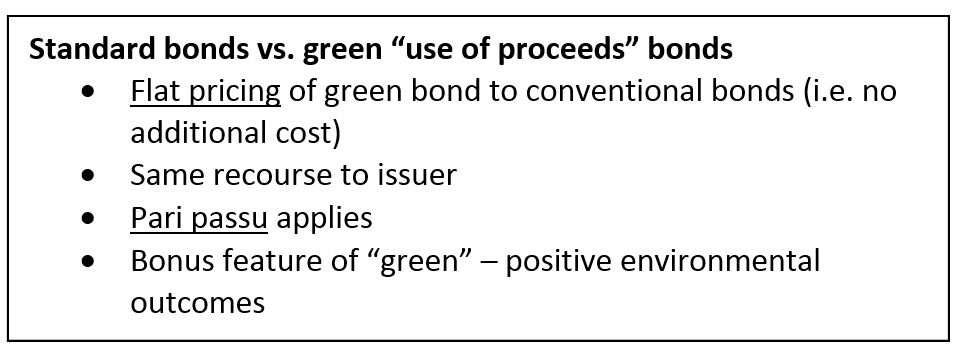

Simply put, a company with no current market data will have to look at its current or implied credit rating and comparable debts to estimate its cost of debt. When comparing, the capital structure of the company should be in line with its peers.

Where D and E are the market values of debt and equity of the chosen comparable firm. •Kd⁎ is the cost of debt capital netted by the benefit of debt leverage. Where D and E are the market value of debt and equity of the chosen comparable firm.

It’s calculated by a business’s accounting department to determine financial risk and whether an investment is justified. Fortunately, the information you need to calculate the cost of debt can be found in the company’s financial statements. The cost of debt metric is also used cost of debt to calculate the Weighted Average Cost of Capital , which is often used as the discount rate in discounted cash flow analysis. This means that businesses tend to load up on debt when they need additional funding, rather than selling shares of their preferred or common stock.

Private Capital, Regional and Local Banks Step Up to Make Loans.

Posted: Tue, 07 Feb 2023 13:35:04 GMT [source]

If Microsoft were contemplating investing in a semiconductor lab, for example, it should look at how much its cost of capital differs from that of a pure-play semiconductor company’s cost of capital. For an investment with a defined time horizon, such as a new-product launch, managers project annual cash flows for the life of the project, discounted at the cost of capital. However, capital investments without defined time horizons, such as corporate acquisitions, may generate returns indefinitely. Say, for instance, an investment of $20 million in a new project promises to produce positive annual cash flows of $3.25 million for 10 years. If the company has underestimated its capital cost by 100 basis points (1%) and assumes a capital cost of 9%, the project shows a net present value of nearly $1 million—a flashing green light. But if the company assumes that its capital cost is 1% higher than it actually is, the same project shows a loss of nearly $1 million and is likely to be cast aside.

The answers to six core questions reveal that many of the more than 300 respondents probably don’t know as much about their cost of capital as they think they do. Calculating the cost of debt using the after-tax cost of debt formula is a simple process once you know where to find the inputs and the reasoning behind the line items. Okay, now that we have some numbers, we can calculate our after-tax cost of debt for Microsoft. To better understand the impact of tax savings on the cost of debt and earnings, let’s look at a simple example. Keep in mind that the interest expense that we find on the income statement represents the total interest paid for both debt and leases.

Content

Growth produces cash flows in the future and the present value of these cash flows is much smaller at high interest rates. Consequently the effect of changes in the growth rate on the present value tend to be smaller. When using the price earning to growth and dividend yield ratio to analyze a stock you want https://online-accounting.net/ the resulting calculation to be below 1.0. A score of 1.0 or below means that the stock is currently selling at a great cost and that the stock has high growth potential or high dividend yields. The payout ratio could also be calculated by merely dividing the DPS ($2.87) by the EPS ($3.66) for the past year.

The computers that amass company data for databases have a hard time integrating negative equity. It throws out of whack the ratios for debt-to-equity, price-to-book, return-on-equity, etc.

But NO. This study looked at how the general market changed over time. It did not distinguish between companies paying different payout levels. The same companies behaved differently at different points in time.

Most importantly it prevents the cost of the purchase from being expensed and reducing Net Income. All other assets and liabilities purchased eventually work through the Income Statement. Rarely is goodwill expensed until a major disaster hits – too late. The market crash of 2008 saw dozens of companies take a big bath and write off large chunks of goodwill … Because they had an excuse and knew investors would discount the expense. In reality the goodwill probably had had no value since soon after the business was bought. The point here is that knowing where the profits are go, helps you determine where future growth will come from.

It must have value because of the extra profits resulting from the purchase . But that argument ignores the changes to reported Net Income if Goodwill were expensed. The reported Net Income would be severely reduced – if not zero.

The sales per share metric is calculated by dividing a company's 12-month sales by the number of outstanding shares. A low P/S ratio in comparison to peers could suggest some undervaluation. A high P/S ratio would suggest overvaluation.

Be clear what you want measured in different circumstances. When there is an industry-wide stock price correction the P/bk premium will shrink. The smaller premium leads to less of a boost to Bk/sh and EPS. The smaller growth in Bk/sh and EPS leads to a lower growth expectation and lower stock price, which leads to even lower premiums from share issues, etc, a destructive cycle. The metrics you look at are Gross Margin, Operating Margin and Net Margin.

A PEGY ratio below 1.0 represents a potential investment opportunity as it indicates the stock has high dividend yields or potential growth and is currently selling at a bargain price. To answer that question, you need to look at individual stocks and companies. In a world where macroeconomic growth is expected to weaken and aggregate earnings growth for the market has slowed to the low single digits, grabbing for yield at any price isn’t the solution in our view. And if the drop in yields reverses, as it did in early September, these overvalued sectors could decline significantly. While serving as portfolio manager of the Vanguard Windsor fund from 1964 until his retirement in 1995, John Neff employed a value investing approach using a stringent contrarian viewpoint. Neff perennially found undervalued, out-of-favor stocks in the bargain basement.

Are You Seeking Passive Income? Try These 2 Dividend Kings.

Posted: Mon, 30 Jan 2023 09:54:00 GMT [source]

While the PEGY ratio doesn’t tell the whole story of a stock’s potential for appreciation, it provides investors with a starting point in their stock analysis. Cyclical stocks operate in industries that are strongly impacted by the strength of the economy. When evaluating cyclical stocks, realize that earnings fluctuate under the best of company circumstances. Stockcharts.comThe company can be picked up at 56% of its book value and trades with a price-earnings ratio of 9.91. Earnings per share are up this year by 8.00% and the past 5-year record of EPS growth is 3.70%. This is another one where shareholder equity exceeds long-term debt. Since dividends are, by definition, a portion of a company’s profits that are paid to its shareholders, what happens to the dividend when a company earns fewer profits or even begins to lose money?

In closing, we can cross-check the implied share price from the justified P/E and the current share price to ensure our calculation is correct. Suppose a company paid a dividend per share of $1.00 in the most recent reporting period. The justified P/E ratio can be thought of as an adjusted variation of the traditional price-to-earnings ratio that aligns with the Gordon Growth Model .

Like other ratios, you lose nuance when comparing companies. Unlike ratio-only investing, a true discounted cash flow model with appropriate inputs can catch everything . Remember that ratios can be a good starting point but cover up a lot. When comparing growing companies, Peter Lynch was a big fan of the PEG ratio – but adjusted it to add dividend yield in the PEGY. You can read more about his reasoning in One Up on Wall Street .

Even when the bad news proves to be not nearly as severe as originally anticipated, the memory of the unpleasant experience lingers. Stockcharts.comRight now, Buenaventura is available for purchase at just 46% of its book value and trades with a Price/Earnings to Growth and Dividend Yield price-earnings ratio of 7.40 (the p/e of the S&P 500 is 20.37). Earnings per share this year are up 187% and the past 5-year EPS growth is 19.20%. A stock’s dividend yield does not include the return you receive from the increase in stock price.

Content

You also need to be able to work together well so that the just-in-time system works well for both of you. Additionally, the production line can shift to fix quality problems much faster. This eliminates secondary quality problems from arising due to playing “catch up” on customer orders. Any orders that come in during production are handled with the same steps, so there’s no backlog and inventory doesn’t accumulate in your warehouse.

It requires minimal up-front expenditure, low inventory levels, and quick-moving inventory. The same disadvantage that makes supply chain problems felt sooner by a just-in-time company also affects their response to sudden shifts in demands. If demand suddenly increases, the JIT system may not have the flexibility to cope with this demand, leading to stockouts. A side benefit of just-in-time manufacturing is an overall tendency toward better quality. This is largely due to the smoother production cycles in this model.

They use an ERP system to gather information on shipping, customer satisfaction, loss prevention, warehousing, purchases, reorders, goods in storage, receiving, stock turnover and more. Companies often adopt JIT inventory management as a cost-cutting strategy. When implemented correctly, JIT can create more value than traditional methods that require more extensive inventories.

With increased competition and pressure to increase profits, many companies have adopted this strategy to boost their bottom line — which can be problematic when supply chains halt. For example, medical products such as syringes or needles https://business-accounting.net/ are critical for society. These parts are necessary regardless of whatever supply chain-related problems happen. Therefore, this industry needs to maintain safety stock to ensure that these products are still available during a crisis.

An inflexible supply chain weighed down with long-lead orders and full warehouses means the company can’t respond to changing trends and new opportunities. Some companies have said, “Inventory equals death.” In other words, the company can’t survive with excess inventory on-hand. The surplus on resources can fatally impair the company’s financial health if it is not sold or used in a timely manner.

There are a few things businesses should consider before implementing just-in-time inventory, such as the type of business, the products being produced, and the availability of suppliers. In addition, businesses will need to have a good understanding of their inventory needs and production demands. If a supplier has a problem and What is Just in Time inventory management? cannot deliver the parts that a just-in-time company needs, that company will be unable to produce its products. The just-in-time company may also have to go back to its regular suppliers, which could disrupt its production schedule. Therefore, any JIT manufacturing company must have reliable suppliers to operate effectively.

A great example of a company using JIT is Dell, which revolutionized the computer world in the 1990s by selling “custom-made” computers to customers over the phone and, later, online. Dell does not possess the raw materials needed to build a computer until a customer places an order.

Midsize Businesses The tools and resources you need to manage your mid-sized business. Your Guide to Growing a Business The tools and resources you need to take your business to the next level. Your Guide to Running a Business The tools and resources you need to run your business successfully.

With JIT, you don’t have to worry about unwanted inventory in the event an order gets canceled or is not fulfilled for any other reason. Grocery stores are a good example of businesses that implement JIT.